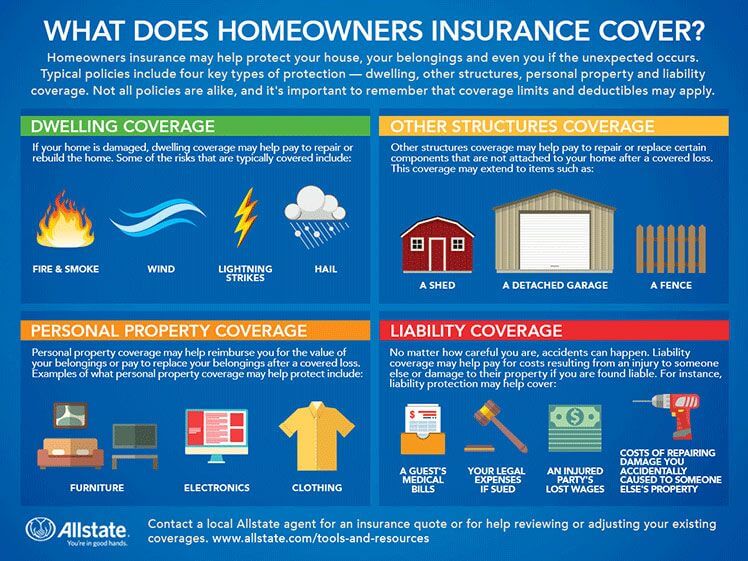

Homeowners insurance is a bundle of coverages (into a single policy) that can protect homeowners from unforeseen damage or loss from events such as weather, theft or vandalism. It provides relief in the form of cash or replacement of the contents of the home and the structure itself. It provides liability coverage against claims from others that may have been harmed on your property. It also provides coverage for the use of the home, as well.

Is Homeowners insurance required by law?

What does Homeowners Insurance cost?

The costs of homeowners insurance depend on a number of factors, including the coverages you select, features of your home and the value of your personal belongings. There may also be extra costs for additional coverage or increased coverage limits.

Covered perils

Basic-form covered perils:

- Fire

- Lightning

- Windstorm or hail

- Explosion

- Smoke

- Vandalism

- Aircraft or vehicle collision

- Riot or civil commotion

Broad-form covered perils:

- All basic-form perils

- Burglary, break-in damage

- Falling objects (e.g. tree limbs)

- Weight of ice and snow

- Freezing of plumbing

- Accidental water damage

- Artificially generated electricity

Special-form excluded perils:

- Ordinance of law

- Earthquake

- Flood

- Power failure

- Neglect

- War

- Nuclear hazard

- Intentional acts

What is property insurance?

You may also like

Home insurance, what it covers and why it’s worthwhile

When it comes to home insurance, the reaction is almost always the same: there is a tendency to make doubt and skepticism the mainspring of every choice and rather than investing in a guarantee, you give up a priori to make an expenditure, often considered unjustified. One should, instead, abandon all cultural conditioning and persuade… Continua a leggere Home insurance, what it covers and why it’s worthwhile

Pet Insurance: why it is the best choice

Pet policies are gaining momentum in the insurance industry. Thinking about a coverage both for our friends and for those who have or will have to do with them means getting a total protection against any inconvenience that may occur. Let’s think, for example, of the possible damage that one of our pets could cause… Continua a leggere Pet Insurance: why it is the best choice

Why it is important to make a life insurance

Life insurance can be very beneficial: here’s what it is and what types exist. The subject is morally challenging, as feelings such as conscience, love and affection for family members are the driving forces behind this investment. In fact, life insurance is a gift that is given to those who love themselves and their loved… Continua a leggere Why it is important to make a life insurance

Black box car insurance: what it is and how it works

If you are looking for a quick way to save money on your car insurance policy, know that the solution is really at hand. In recent years, black box car insurance has appeared on the market, able to guarantee practical and economic advantages to customers. Save on car insurance by installing the black box Let’s… Continua a leggere Black box car insurance: what it is and how it works